best tax saving strategies for high income earners

Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free. Dont discount the wealth-generating potential and flexibility an HSA can afford.

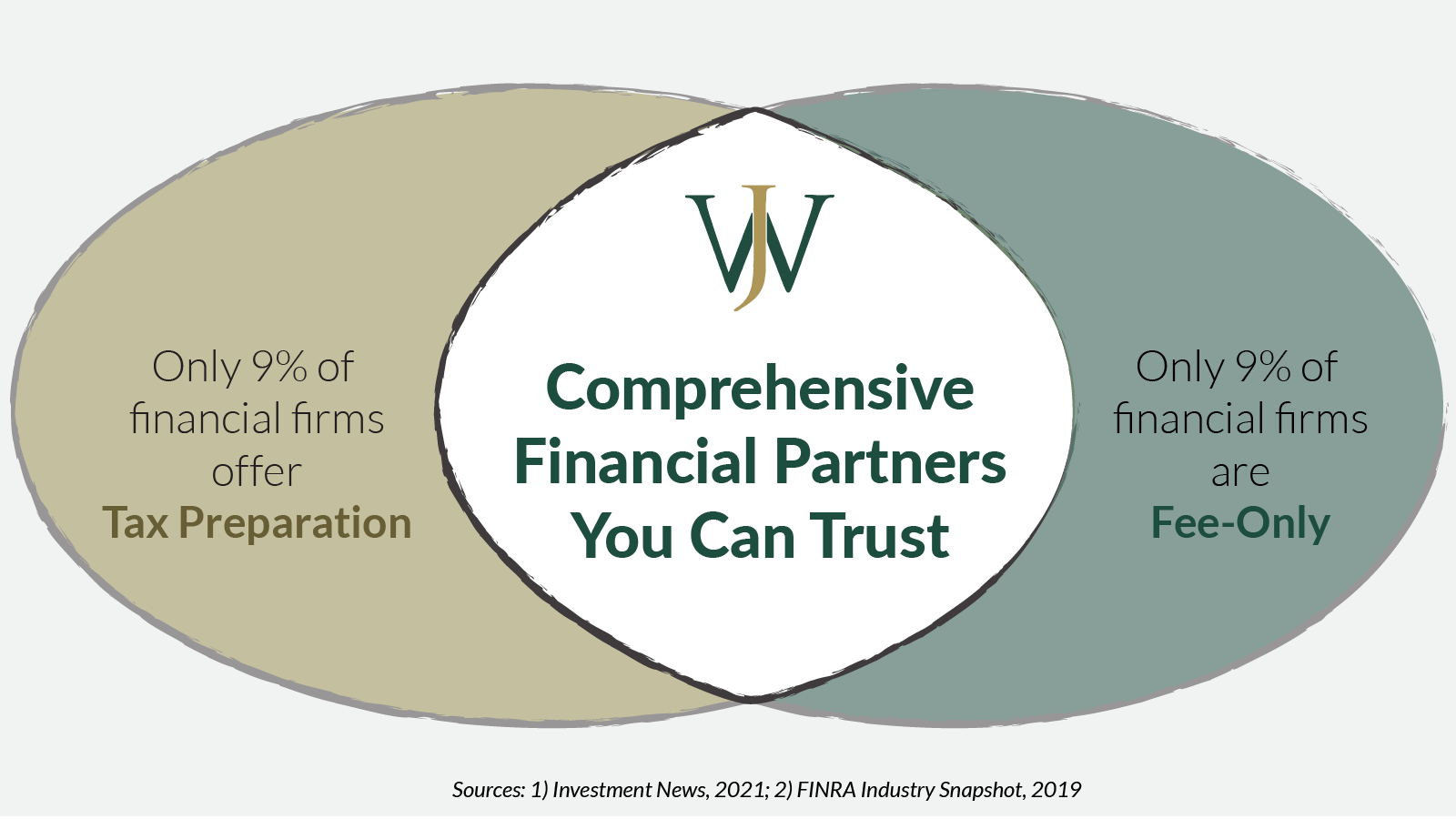

Tax Strategies For High Income Earners Wiser Wealth Management

When you donate to charity you enjoy the privilege of a tax deduction in the year the.

. We will begin by looking at the tax laws applicable to high-income earners. Tax saving strategies for high-income earners dont always have to be complicated. 3 Tax-Saving Opportunities For High-Income Earners.

The total contribution limit for a 401 k plan in 2021 is 58000 plus an additional 6500 for those 50 and older or 100 percent of an employees compensation whichever is. The more you make the more taxes play a role in financial decision-making. Open Online in Minutes.

Let Our Expert Tax Lawyers Fight for You. If you are an. For this strategy to be effective your partner must have a lower marginal tax rate than you do.

Free No Obligation Consultation. Real Time Rate Comparison. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

Our tax receipt scanner app will. In this way the net income from the. Learn About Our Full Suite Of Funds Today.

In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege. Tax Planning Strategies for High-income Earners. Taxes associated with your investments are driven by the types of.

Buying assets in your partners name. Has The IRS Taken Your Paycheck. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Another effective and simple technique is to gift stock directly to a charity. In this post were breaking down five tax-savings strategies that can help you keep more money in. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions.

All individuals that own these types of businesses can qualify for this 20 t ax rate deduction however there are limitations if you own a service business. High-income earners make 170050 per. A donor-advised fund is a charitable fund that allows you to decide how and when to allocate funds to charitiesThis is probably one of the best tax saving strategies for high income.

Ad Owe 10000 Or More In Back Taxes. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Ad These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank.

Ad Your Clients GoalsOur Investment Solutions. Find Out How PIMCOs Tools Resources Can Help Investors Stand Up To Market Challenges. The SECURE Act.

Donating to charity is one of the smartest tax-saving strategies for high-income earners. In fact Bonsai Tax can help. An overview of the tax rules for high-income earners.

Has The IRS Taken Your Paycheck. 1441 Broadway 3rd Floor New York NY 10018. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

Let Our Expert Tax Lawyers Fight for You. Start Maximizing Your Interest Today. Download the free Definitive Guide to Retirement Income for 500k portfolios.

Free No Obligation Consultation. 50 Best Ways to Reduce Taxes for High Income Earners. Ad Open a New Savings Account in Under 5 Min.

These Well-Reviewed Savings Accounts Earn More Interest Than The National Average. Ad Owe 10000 Or More In Back Taxes. Mon - Fri.

Max Out Your Retirement Account. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Structure your investments tax efficiently. A Solo 401k for your business delivers major opportunities for huge tax. Ad Approach retirementwith an informed investment income plan.

Your Slice of the Market Done Your Way.

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

9 Ways For High Earners To Reduce Taxable Income 2022

3 Tax Strategies For High Income Earners Pillarwm

3 Tax Strategies For High Income Earners Pillarwm

The Hierarchy Of Tax Preferenced Savings Vehicles

Who Benefits From Tax Expenditures Chart

5 Outstanding Tax Strategies For High Income Earners

3 Tax Strategies For High Income Earners Pillarwm

5 Outstanding Tax Strategies For High Income Earners

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Financial Motivation Quotes To Live By

9 Ways For High Earners To Reduce Taxable Income 2022

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Tax Strategies For High Income Earners Wiser Wealth Management

How High Income Earners Can Reduce Taxes Through Tax Planning Financial Planning

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners 2022 Youtube

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Finance Roth Ira Wealth Building

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesm Small Business Tax Tax Consulting Accounting